Capital Investment Analysis for a Full-Scale Spodumene Beneficiation Plant

Laura

Laura

Nov 25, 2023

Nov 25, 2023

850

850

If you want to know more details about equipment, solutions, etc, please click the button below for free consultation, or leave your requirements!

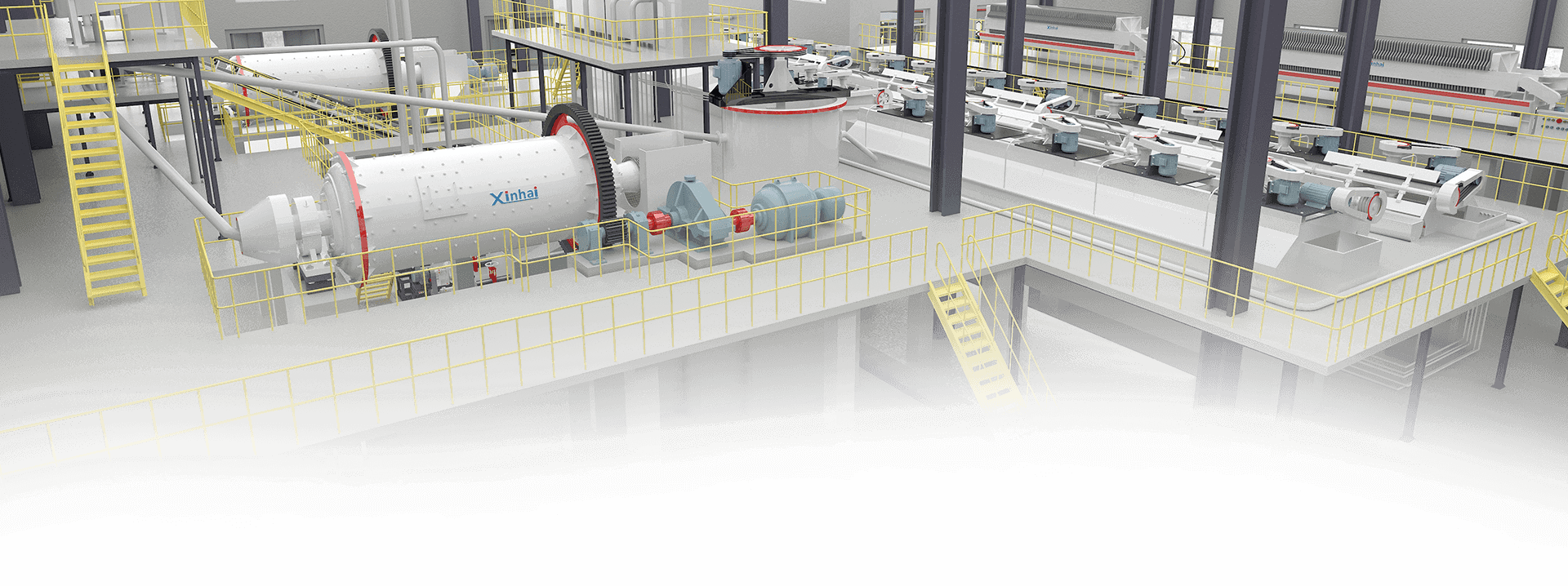

( 3D mineral processing plant renderings )

The global demand for lithium has been steadily increasing due to its crucial role in the production of rechargeable batteries for electric vehicles, portable electronics, and renewable energy storage systems. Spodumene, a lithium-bearing mineral, has emerged as a valuable source of lithium, driving the need for full-scale spodumene beneficiation plants. However, establishing such a plant requires a comprehensive capital investment analysis to assess the financial viability and potential returns. In this article, we will delve into the key components of a capital investment analysis for a full-scale spodumene beneficiation plant, exploring the factors that impact costs and returns.

01Market Analysis

BackBefore embarking on a capital investment analysis, it is essential to conduct a thorough market analysis. This involves assessing the current and projected demand for lithium, understanding market dynamics, and evaluating the competition. Factors such as lithium prices, market growth rates, and emerging technologies will influence the viability of a spodumene beneficiation plant.

02Plant Capacity and Production Process

BackDetermining the plant capacity is a crucial step in the capital investment analysis. It involves assessing the available spodumene reserves, mining rates, and processing capabilities. The production process for spodumene beneficiation typically includes crushing, grinding, flotation, and chemical treatment. Each stage requires specific equipment and infrastructure, which must be considered in the cost estimation.

03Capital Expenditure (CAPEX)

BackCAPEX refers to the initial investment required to establish the spodumene beneficiation plant. It includes the costs associated with land acquisition, site preparation, plant construction, and equipment installation. Additionally, infrastructure such as power supply, water management systems, and waste disposal facilities should be accounted for. Detailed engineering studies and cost estimates are essential to accurately determine the CAPEX.

04Operating Expenditure (OPEX)

BackOPEX comprises the ongoing expenses associated with running the spodumene beneficiation plant. These expenses include labor costs, raw material procurement, energy consumption, maintenance, and administrative expenses. Factors like labor productivity rates, energy prices, and maintenance schedules need to be considered when estimating the OPEX.

05Revenue Projections

BackEstimating the revenue generated by the spodumene beneficiation plant requires a comprehensive analysis of the product pricing, projected sales volumes, and potential customers. Market trends, contractual agreements, and off-take arrangements will influence the revenue projections. It is crucial to consider the long-term price outlook for lithium and the potential impact of market fluctuations on the plant's profitability.

06Cash Flow Analysis

BackA cash flow analysis helps evaluate the financial viability of the project. It considers the timing of cash inflows and outflows, taking into account capital and operating expenses, revenue generation, and taxation. The analysis calculates key financial metrics such as net present value (NPV), internal rate of return (IRR), payback period, and profitability index. These metrics assist in assessing the project's attractiveness and potential returns.

07Sensitivity Analysis

BackPerforming a sensitivity analysis is essential to understand the project's sensitivity to key variables such as lithium prices, production costs, and market demand. By varying these variables within a reasonable range, the analysis can identify potential risks and evaluate the project's resilience to market fluctuations. Sensitivity analysis helps stakeholders make informed decisions and develop risk mitigation strategies.

08Financing Options

BackIdentifying suitable financing options is crucial for the successful implementation of a spodumene beneficiation plant. Traditional financing methods such as debt and equity financing should be explored. Additionally, government grants, subsidies, or partnerships with strategic investors might be available to support the project. Evaluating the cost of capital and the associated risks is vital when determining the financing structure.

09Regulatory and Environmental Considerations

BackCompliance with regulatory requirements and environmental standards is essential for the smooth operation of a spodumene beneficiation plant. The capital investment analysis should account for the costs associated with environmental impact assessments, permits, and ongoing compliance. Failure to adhere to regulations can result in substantial fines, legal issues, and reputational damage.

10Conclusion

BackA comprehensive capital investment analysis is crucial for assessing the feasibility and potential returns of a full-scale spodumene beneficiation plant. By considering market dynamics, plant capacity, capital and operating expenditures, revenue projections, cash flow analysis, sensitivity analysis, financing options, and regulatory considerations, stakeholders can make informed decisions regarding the project's viability. With the increasing demand for lithium, strategic investments in spodumene beneficiation plants have the potential to provide substantial returns while supporting the growing clean energy industry.

Want to maximize your returns in the lithium industry? Our team can guide you through the capital investment process for a spodumene beneficiation plant. Get in touch today!

+86 18716000713

+86 18716000713 xlyin@xinhaimining.net

xlyin@xinhaimining.net

Message

Message Chat Now

Chat Now